Governments that are on a calendar year are readying for their year-ends. Those governments are seeing the looming implementation of GASB Statement No. 87, Leases (GASB-87). For calendar year governments, implementation would begin in less than two weeks, unless the government issues fully comparative statements. In those cases, implementation should have begun at the start of 2021.

Some calendar year governments are looking at what their June 30th peers are doing. But should they? As stated in many entries of the Governmental GAAP Update Service, governments may not be able to look at peers for decision-making and best practices for policies and procedures. Every government is different. Some governments are strictly lessors. Most governments are lessees. Other governments have contracts that are subject to regulation. Policies, procedures, systems, risks, and organization structure will differ from government to government. In other words, the tried-and-true method of many governments – copying from your neighbor – may not work.

Due to these vagaries, twelve frequently asked questions involving GASB-87 that I receive rise to the top. This article reviews those questions so that governments that have not started implementation yet at least scratch the surface on some of the issues that lie ahead.

FAQs Involving the Basics of GASB-87

One of the easier questions I receive is likely from someone who is typing it while screaming:

Will the GASB repeal or extend implementation of GASB-87?

From the well-known commercials, I put on my best ‘Dr. Rick’ voice and try to dissuade the sender from becoming our parents. I provide a one-word answer most of the time: No. As of the date of this article, a further extension or repeal is not on the GASB’s Technical Plan. And yes, GASB-87 applies to all state and local governments.

A trickier question then: Is this contract a lease?

GASB-87 defines a lease as “a contract that conveys control of the right to use another entity’s nonfinancial asset (known as the underlying asset) as specified in the contract for a period of time in an exchange or exchange-like transaction. Each of the italicized words and phrases are precious in making this determination. Contracts may be oral, written, or implied. A best practice is to have a written contract, especially since these are legal documents. As we have learned in implementing GASB Statement No. 84, Fiduciary Activities, ‘control’ is also important. Control is present when the other party has the right to obtain present service capacity from the use of the underlying asset as specified in the contract. The other party must also have the right to determine the nature and manner of use of the underlying asset as specified in the contract. Given the specificity, again, the contract should be written.

Governments that have implemented GASB-87 have realized that once the particulars of a contract are known and GASB-87 applies, the math is just like a mortgage. However, to do the math, the principal, interest, and the time element must be known. In some situations, especially with easements, there is no time element. Those contracts are perpetual. Therefore, GASB-87 would not apply in those situations.

Finally, an exchange transaction is generally understood to be value for value. Exchange-like transactions are defined in a footnote to GASB-87 as one values are exchanged, though related, are not quite equal or when the direct benefits may not be exclusively for the parties to the transaction. What does this mean? Contracts between parties for $1 per year for 99 years are unlikely leases within the scope of GASB-87.

Another FAQ involves embedded leases.

GASB-87 has some text that alludes to the issue of contracts that are not identified as a lease but align to the framework within GASB-87. The American Institute of Certified Public Accountants (AICPA) made mention to this issue in an emphasis point within a nonauthoritative Appendix to the 2021 Audit and Accounting Guide States and Local Governments. Such contracts may not use ‘lease’ or ‘rent’ in them and may be present within other contracts. The AICPA mentions ‘as-a-service contracts, sales contracts, advertising, transportation or construction and related-party contracts as examples of where embedded leases may be present. Governments implementing GASB-87 may be surprised when they do a search for contracts with minimum payments that are not recorded as leases. We have found such contracts involving water delivery, lab equipment and other medical equipment situations.

The opposite may be true as well. There may be contracts that are called leases, when in fact, the contract is a borrowing or financing in accordance with GASB-87, paragraph 19. In those contracts, title ultimately transfers. Such contracts should be reclassified from a lease.

These issues derive a further FAQ – is this particular contract in-scope or out-of-scope for GASB-87.

It is well-documented that intangible assets are mostly out of scope but be careful on software due to the forthcoming GASB Statement No. 96, Subscription-Based Information Technology Arrangements. Biological assets, inventory, supply contracts or where there is not exclusive use of the underlying asset are also out of scope. Service concession arrangements and conduit debt are held aside for a year also due to forthcoming GAAP (GASB Statement Nos. 94 and 91, respectively). For lessors, special care must be taken for contracts where the underlying asset is an investment, such as a building leased by a defined benefit plan. Airports and ports may also have contracts subject to regulation which require special review.

Another FAQ usually is how to calculate the lease term?

Again, analysis of the contract is required to determine the term as follows:

1. Figure out the period where neither party can cancel (known as the noncancelable period).

2. Add options where the lessee has an option to extend and / or where the lessee has an option to terminate the lease but is choosing not to.

3. Add where the lessor has an option to extend the lease and / or where the lessor has an option to terminate the lease but is choosing not to.

The total of these is the lease term. However, if there are periods where both parties have an option to terminate or extend without permission of the other, those periods are excluded.

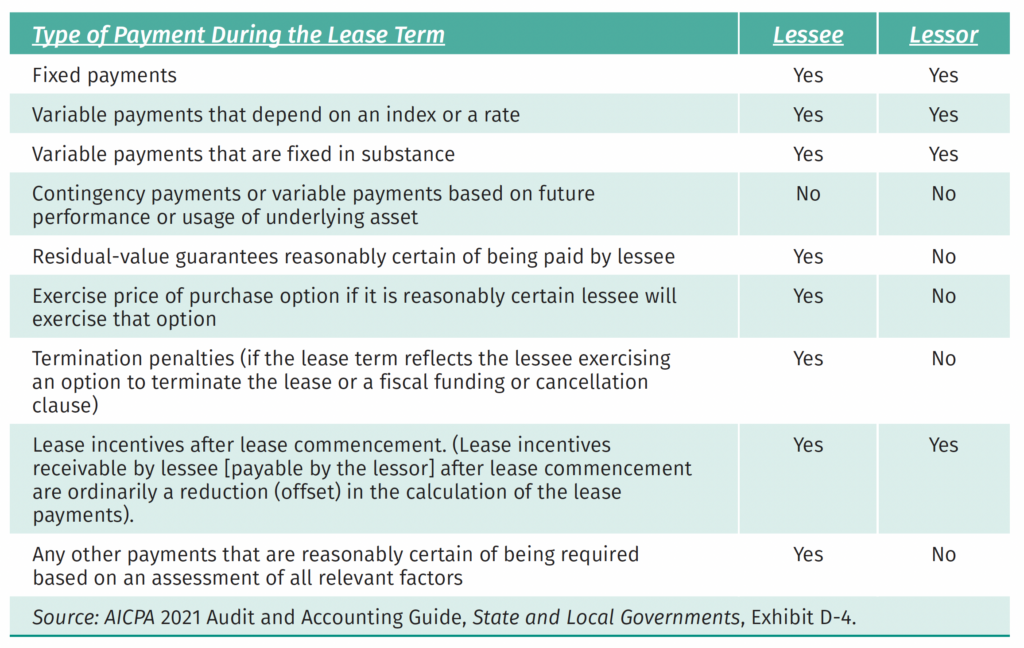

Once the term is calculated, a question then arises, how to determine the asset or liability? The flow of funds needs to be determined with a caution – some flows may be excluded from the asset or liability depending if the government is a lessee or a lessor. The AICPA includes an easily read table within the Appendix introduced previously to determine which payments to include or exclude:

The final basic FAQ usually is related to the discount rate process.

After all, the government has calculated the term, calculated the payments during the term, but what discount rate should be used? Fortunately (or unfortunately), GASB-87 provides principles in determining the rate. Again, all governments will differ, and all contracts will differ.

In the nearly two years this author has aided governments in implementing GASB-87, not one contract had an explicit interest rate within a contract. Since the rate is unlikely to be disclosed, a government can use its incremental borrowing rate. However, many governments do not have regularly issued debt that may have a maturity that reasonably aligns to a contract term. A government can impute the interest rate. However, imputation only works well if the fair value of the underlying asset is known at the start of a contract and can be estimated at the end of a contract. Vehicle leases may fall under this category.

Governments are then left to design an effective policy and procedure to determine the discount rate. If a government has a treasurer or chief financial officer, they should be involved to help in determining and implementing these rates (and how often rates should adjust). Choose the policy that works given your structure. Finally, if the government is a lessor, consider the default risk a lessee may have. A retail establishment may be at a higher risk of default than another, unrelated government. A final policy should be documented and used consistently.

Other Leasing FAQs

The first seven FAQs were just the basics involving leases. The remaining FAQs that I receive involve components, remeasurement, comparative financial statements, policies and whether software is needed.

Components are common in lease contracts, especially for office space, equipment, and vehicles. Office space may have common area charges, utilities, security, and similar payments. Equipment may have required consumables such as supplies for copiers. Vehicles may have maintenance contracts. In implementations thus far, components that I have encountered have been annual contracts. GAAP require the components to be separated from the other lease payments and recognized as payables. The value can be determined

by reviewing similar contracts at the government. If no similar contracts are available, use professional judgment, but document the results.

Remeasurement of a lease contract is required in five different circumstances, two of which do not apply if the government is a lessor. Remeasurement is required when there is:

• A change in the lease term, or

• A likelihood of a residual value guarantee being paid or a purchase option being exercised that has changed from reasonable certainty to uncertain or vice versa (does not apply to lessor contracts), or

• A change in the estimated payments already included in the measurement of the lease liability, except for those variable payments that depend on an index or rate, (also does not apply to lessor contracts), or

• A change in the interest rate the lessor charges the lessee if the rate was explicit, or

• A contingency upon which some or all the variable payments that will be made over the remainder of the lease term are based is resolved such that those payments now meet the criteria for measuring the lease liability.

As introduced previously, required comparative financial statements may trigger a seemingly early implementation of GASB-87. When implementing, all prior periods are to be restated if practicable. Given that the contracts are written, it is difficult for a government to say that it is impracticable to implement as required.

The discount rate policy is only one of many policies that may need review. All too often, a government has asked if a materiality policy should be drafted. Indeed, GAAP does not apply to immaterial items. But there is no way to calculate materiality without knowing the entirety of the population of contracts in scope. A recognition of lease contracts policy then is essential. Other policies that may be needed include where documents are kept, authorized signatories, review and approval of renewals, terminations, modifications, and related-party leases. Other policies may also be needed based on your government’s leasing activity.

Finally, leasing software is not always essential. If your government only has a small number of leases that it thinks it can manage, then software may not be necessary beyond a spreadsheet. For many governments, software is needed to recognize, measure, document and report leasing information. No ‘off the shelf’ solution is out there for every government. Governments may want to consider how software integrates with existing enterprise resource planning systems, business practices and information technology infrastructure before making a choice. In many cases, a project management specialist may be needed.

Conclusion

I have stressed the importance of understanding, planning for, and executing the implementation of GASB-87. Now is the time. Sure, your government may only have a few contracts that may be in scope. But how do you know without working through the issues? How do you answer the question: did we recognize all that we needed to recognize? How do you maintain the contracts once implemented on a go-forward basis?

No, GASB-87 is not as a difficult of implementation as GASB-68 or GASB-75 was for most governments. But GASB-87 may have a broader impact depending on your government.

Again, if your government has not started, now is the time.

For more information on GASB, we recommend our upcoming webinar lead by Eric Berman: GASB vs. FASB – April 2022

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

Yellowbook-CPE.com is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: